The Quantum Computing Opportunity is NOW (but not in the stock market)

Or why even billionaires seek attention; a story of human nature

Quantum friends,

I just arrived in beautiful Doha to chair the Quantum.Tech Qatar conference and with 34,000 feet of perspective… here is mine.

Jensen Huang, NVIDIA’s CEO, raised quite the stir with his remarks on quantum computing, so much so that markets momentarily wobbled and a few suits wondered if quantum might be more vaporware than hardware. And everybody and their sister shared their opinion on LinkedIn and X. In school Jensen would have received an “F” from me; great response but you failed to answer the question. Quantum computing’s clock is ticking, and the next five to ten years will be crucial for positioning your organization to reap the benefits. Rather than exaggerated pessimism or optimism, and a myopic, misguided focus on revenues and cash flow models; active pragmatism is in order. I’ll anticipate the punchline: senior executives, government officials, and big investors need to act now:

Start With Strategic PoCs: Even if you’re not ready for a full-scale rollout, begin targeted proofs of concept now. Focus on areas where quantum can offer a short-to-medium-term ROI, such as security (PQC) or specialized simulations.

Plan for Post-Quantum Security: Integrate PQC readiness into your existing cyber security roadmap. The impending deadlines — highlighted by NSM-10 — leave little room for procrastination.

Invest in Talent and Partnerships: Lock in quantum-skilled talent early and look for vendor collaborations that offer domain-specific solutions. Partnerships reduce risk and accelerate time-to-value.

Balance Hardware & Software: While hardware is critical, don’t overlook the software layer. Allocate resources to algorithm development, hybrid solutions, and domain-focused toolkits that directly address your industry’s most pressing challenges.

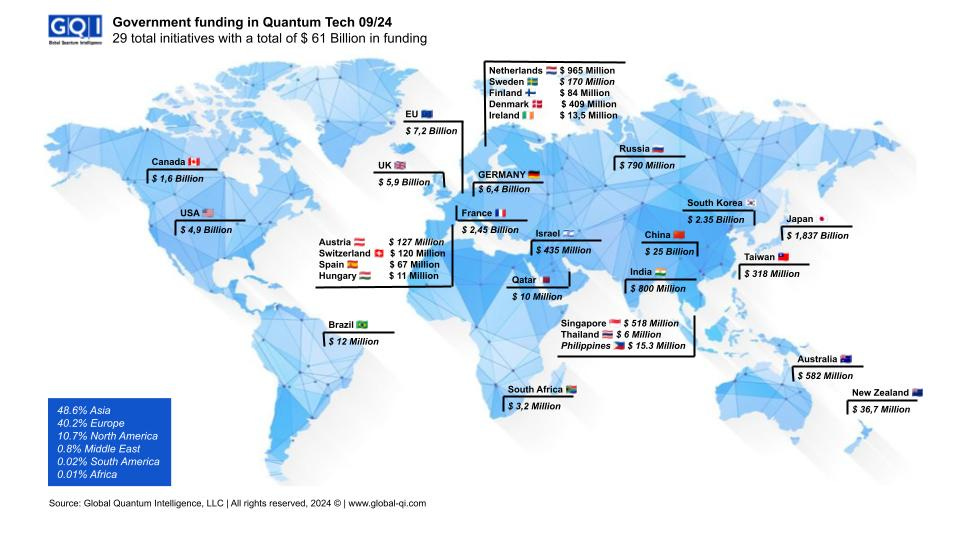

Align With Global Initiatives: Keep a pulse on international quantum programs—whether in the EU, the USA, or elsewhere. Cross-border collaboration and intelligence-sharing can enrich your technical capabilities and strategic positioning.

Prepare for 2030: The year 2030 is shaping up to be a watershed moment. Align your budgets, teams, and strategic roadmaps around the arrival of 100+ logical qubits so you’re positioned to leap at new commercial and national security opportunities.

Those who seize quantum’s potential now will find themselves at a competitive advantage when the technology becomes mainstream. Those who wait too long risk losing out on the most significant computing revolution of our lifetime.

And as for more sunny, commercial use cases, let’s separate fact from hyperbole, and explore why quantum computing remains one of the most strategic plays for Fortune 500 executives, senior government officials, and big investors alike.

The CES Announcement and Its Ripples

At CES, NVIDIA’s chief executive hinted at the challenges facing quantum computing, alluding to tough roadblocks in scaling qubit counts reliably and delivering meaningful commercial value. Anyone who’s been to CES knows that sweeping statements are par for the course — and while Huang was perhaps painting a more conservative timeline, his commentary sparked immediate speculation. Was he pouring cold water on quantum’s near-term viability? Or was he simply cautioning that quantum computing still has hurdles to overcome before it dethrones classical computing in certain high-performance scenarios?

Or is he a very smart CEO, secretly and not so secretly investing into quantum while at the same time cautioning the market about NVIDIA’s competitors?

The reaction was predictable. Many headlines blared a variation of “Quantum Bubble: Is This Still For Real?” Some investors even dialed back their quantum portfolios, rationalizing that NVIDIA’s pull on the GPU and AI computing ecosystem might overshadow quantum in the near term. Even well-informed executives started to wonder if quantum would actually become mainstream. Let me be crystal clear here: Huang’s remarks shouldn’t be interpreted as a eulogy for quantum, but rather a reminder that the quantum revolution won’t be instant oatmeal. It takes time, perseverance, and quite a bit of resilience.

Why Quantum Matters

Despite the recent noise, we’re seeing tangible progress. Governments are investing heavily in quantum, whether it’s the EU’s multi-billion-euro quantum initiative or the U.S. National Quantum Initiative.

Technical progress in quantum computing will continue to ebb and flow. We’ll see breakthroughs (like new qubit designs, improved error correction, and hybrid quantum-classical algorithms) punctuated by periods of consolidation and recalibration. That iterative cycle doesn’t fit neatly with the hype cycles we often see at CES. But rest assured: the next decade remains the most promising horizon for quantum’s adoption. We’re not slamming on the brakes; rather, we’re changing gears to handle the inevitable climbs on the road to commercialization.

Hardware and Software

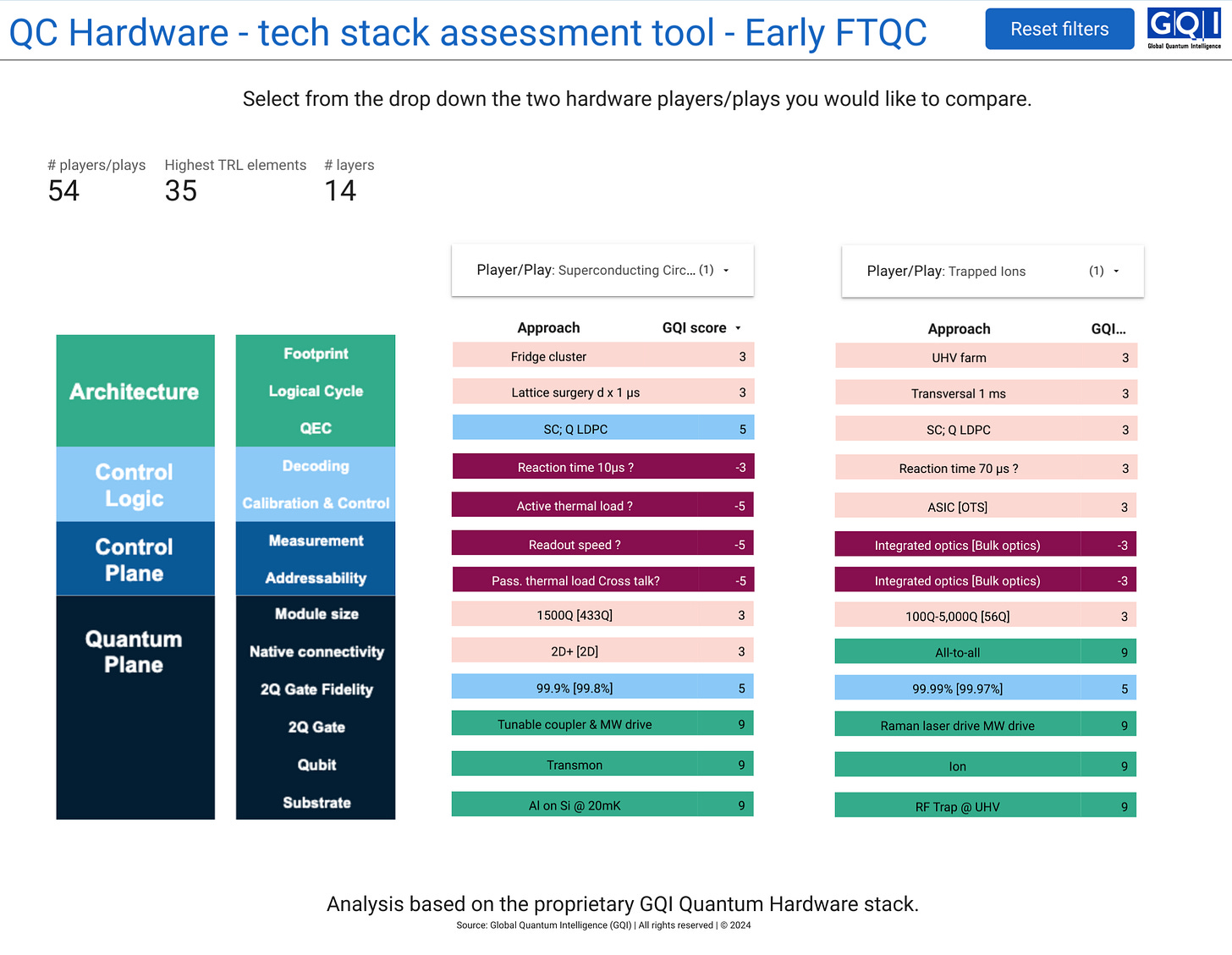

The market tends to focus on the hardware arms race — who’s got the biggest qubit count, or the best error rates. But the real opportunity in quantum also hinges on software and algorithms. As hardware matures, specialized algorithms and quantum development toolkits will be the gatekeepers of business value. GQI provides a comparative analysis of the quantum computing stack. It evaluates technical readiness levels (TRL) and performance across key components of the quantum stack, such as architecture, control logic, control plane, and quantum plane. And, of course, algorithms and applications.

Metrics like logical cycle times, quantum error correction (QEC), reaction times, thermal loads, and gate fidelity are assessed using a proprietary GQI scoring system. This approach highlights the distinct strengths and weaknesses of each platform, guiding stakeholders in identifying optimal approaches for early fault-tolerant quantum computing (FTQC) applications across all qubit modalities, hardware architectures and vendor roadmaps.

Certain sectors stand to gain enormous benefits from quantum, especially once we inch closer to reliable 100+ logical qubits. Even if NVIDIA’s caution slows certain investment patterns, these industries aren’t going to put the brakes on finding potential cures for diseases or revolutionary new materials. They’ll keep investing in quantum R&D because the payoff is too transformative to ignore.

If you glean nothing else from the hue and cry around CES, glean this: in times of uncertainty, partnerships can be a lifesaver. As the quantum ecosystem evolves, no single company can master all aspects of hardware, software, and use-case development. Pursue alliances with specialized quantum hardware firms, software developers, and research labs. The synergy often helps mitigate risk and optimize results. Start building your quantum bench — whether through training, hiring, or partnering — so you can act quickly when breakthroughs do happen.

Market Timing

The USA, China and the EU are investing heavily, each determined to leapfrog the other in fundamental research and technology rollouts. This is not just research-for-research’s-sake; it’s about national security, cybersecurity and economic competitiveness.

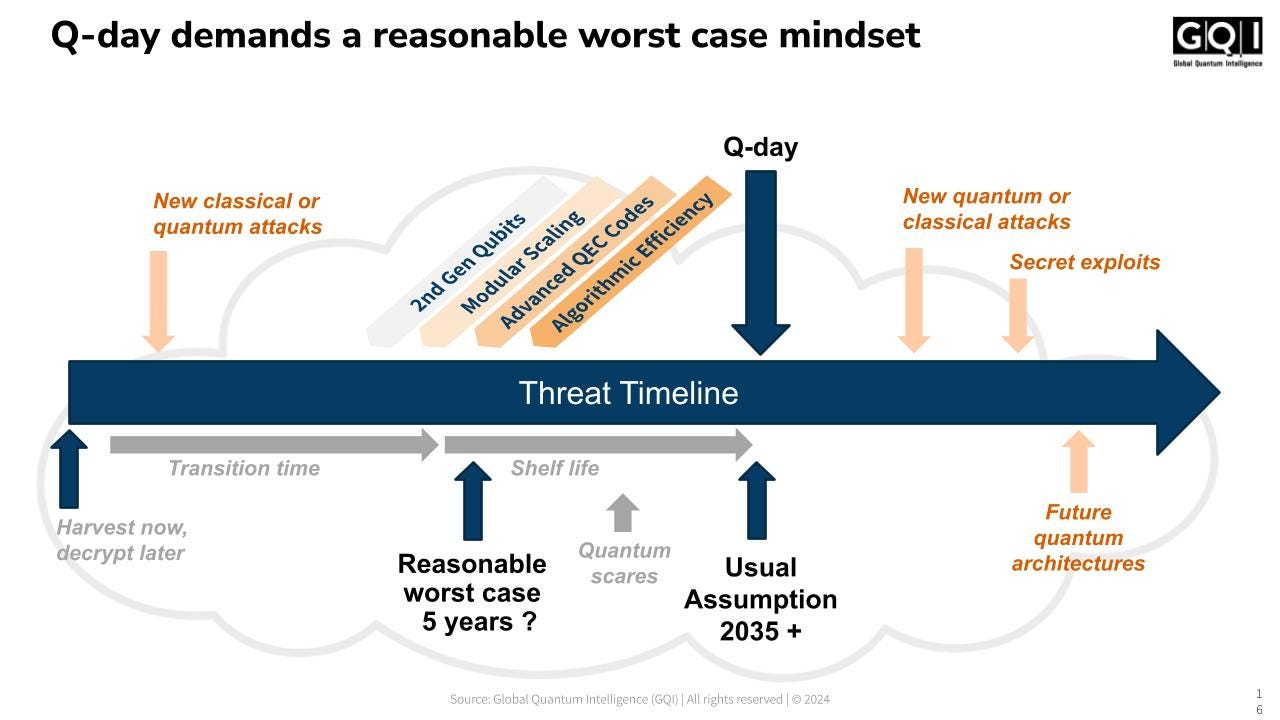

Regulation is rapidly becoming a strategic driver. With the White House’s NSM-10, the U.S. government signaled it wants quantum-safe encryption rolled out between 2025 and 2030. The race to post-quantum cryptography (PQC) is not a distant concern— it’s happening now. Governments from Europe to Asia are drafting standards and mandates that will force corporations to adopt quantum-resistant systems. The message is clear: the cost of ignoring these regulations — or assuming they’re years away — could be massive, both in security breaches and legal liabilities. We need to adopt a "reasonable worst-case mindset" regarding the threat of quantum computers breaking classical encryption standards.

The transition period, during which data is susceptible to "harvest now, decrypt later" attacks, remains fluid and a "reasonable worst-case" assumption of quantum breakthroughs occurring within 5 years and the "usual assumption" of quantum threats emerging post-2035 both need to be weighted equally. The potential for advanced quantum and classical attacks, such as secret exploits and second-generation qubits leveraging modular scaling, advanced quantum error correction (QEC) codes, and improved algorithmic efficiency is real. The urgency of implementing quantum-resistant measures during the transitional period to mitigate vulnerabilities effectively is immense.

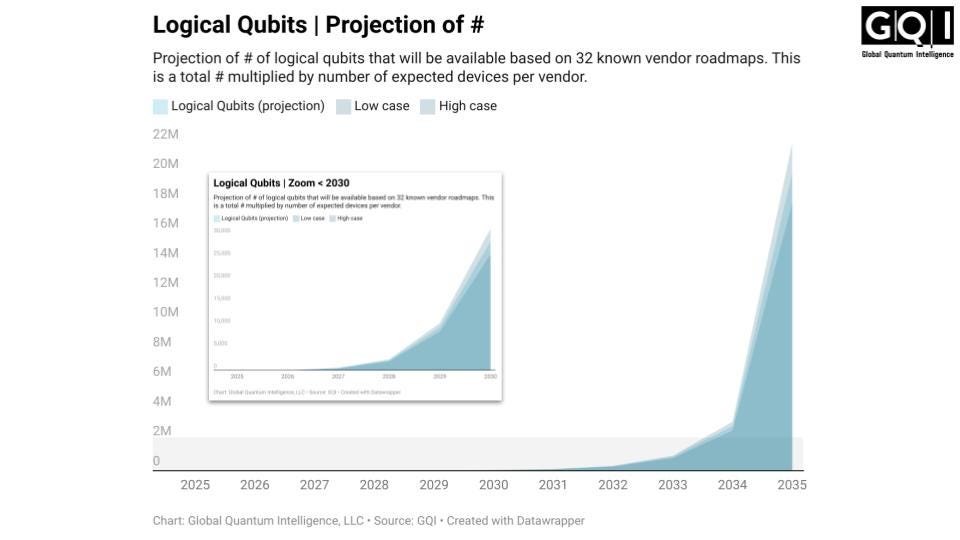

Quantum computing is a marathon, not a sprint. We’re pushing the boundaries of physics in ways that no other technology has before. Efforts from companies like IBM, Google, Microsoft, and others remain laser-focused on building reliable, scalable qubit systems. Roadmaps indicate we’re still on track for 100+ logical qubit devices by 2030.

Key Tipping Points are on the horizon with possible “winters” (periods of reduced investment and enthusiasm) or “shocks” (like cryptographic emergencies) that can significantly alter the pace of quantum adoption. The End-State Vision is that by the 2040s, in the most optimistic scenario, robust quantum networks could link fully fault-tolerant quantum computers and advanced quantum sensors, paving the way for an interconnected quantum infrastructure, sometimes referred to as a “Quantum Internet-of-Things.” And other expressions of quantum tech will take hold along the way.

Investors and Stakeholders need to be looking at quantum tech as an evolving, multi-path trajectory where market scenarios diverge and converge depending on technology readiness, policy, and funding.

Short vs. Long Term: Near-term (2025–2030) improvements are likely centered on NISQ-based advantage and early quantum networks. The truly transformative, large-scale impacts may only emerge in the 2030s and 2040s. Once fault-tolerant quantum computing, quantum-secure networks, and advanced quantum sensors become reality, the economic and societal impacts could be enormous — but the timeline to get there remains uncertain and scenario-dependent.

It is not about a specific timeline. It is about scenarios and pathways with specific risks and payoffs.

Market & Use-Cases

Hardware is the current star of the show, with companies across North America, Europe, and Asia jockeying to scale from dozens of noisy qubits to fully operational systems capable of 100+ logical qubits. We can expect the first wave of 100+ logical qubit machines to arrive as early as 2030, delivering a performance leap sufficient to tackle a broader range of enterprise-grade challenges. This signals a monumental shift from today’s mainly experimental stage toward genuine, practical quantum applications.

While 100 LQs in itself won’t be enough for breakthrough use cases, it will be a clear sign of product maturity and define market fit.

Multiple data points from industry roadmaps and government strategies converge on the early 2030s as the inflection point. By this time, we should see early fault-tolerant quantum systems (FTQC) start to break out of niche proof-of-concept projects and into more mainstream adoption.

The industry’s holy grail — viable quantum algorithms — remains extremely challenging. Because fully error-corrected, large-scale quantum computers are still under development, many researchers are turning to hybrid solvers that combine classical and quantum approaches. The data suggests that these hybrid strategies can reduce total qubit requirements by as much as 30%, enabling businesses to run meaningful experiments sooner.

Algorithms like Quantum Chemistry (e.g., nitrogenase and ruthenium), Factoring, Grover’s, Quantum Phase Estimation (QPE), Quantum Amplitude Estimation (QAE), and Quantum Dynamics are analyzed under different error correction codes and assumptions, including surface codes and Majorana-based approaches. We highlight the trade-offs between qubit requirements and runtime, with some algorithms requiring millions of qubits for practical execution (e.g., Factoring and Quantum Chemistry) while others like Grover’s demand fewer resources. Advanced error correction methods and improvements in logical cycle times (e.g., Floquet codes) can significantly reduce qubit counts and computational overhead. Challenges in scaling quantum hardware and the importance of algorithmic and technological advancements for enabling real-world quantum applications remain critical hurdles on any pathway.

Market Sizing

Industry projections from McKinsey and BCG place total quantum computing revenues at around $16 billion by 2030, $50 billion by 2040, and $100 billion longer term. Initially, hardware investments will command the lion’s share—around 80% of total spending. But post-2030, software’s share could rise to about 20%, climbing to 25% by 2040 as we shift from the “heavy iron” phase to leveraging software services, specialized algorithms, and domain-driven solutions.

We expect a period of steady, measurable growth throughout the 2020s. Crucially, early fault-tolerant quantum computers could deliver around $2 billion in software-driven revenue by 2030–2032. In other words, the interplay between newly available fault-tolerant hardware and advanced software environments is where we’ll see the first hints of quantum’s transformative effects on enterprise-scale workflows.

GQI predicts the Quantum Addressable Market (QAM) from 2025 to 2030 to be of a similar size ($15B to $20B excluding quantum safe migrations), highlighting a steady and exponential increase in market value over time. Categories such as quantum sensing (e.g., detection, ranging, and medical diagnostics), cybersecurity (e.g., quantum-safe protocols and discovery/remediation), simulation (e.g., materials design, energy conversion, and pharma drug development), machine learning (e.g., fraud prevention and autonomous vehicles), and optimization (e.g., finance portfolio and logistics) form the key contributors. The diversity of applications reflects the transformative potential of quantum computing across industries, with a notable emphasis on simulation and optimization in early stages, followed by increasing adoption in cybersecurity and advanced machine learning by 2040 and beyond. We underscore the broadening scope of quantum technology's economic impact, with the market estimated to exceed $1 trillion annually by mid-century.

Conclusion & Recommendations

Jensen Huang’s CES comments on quantum computing may have rattled the markets, but they shouldn’t derail a forward-looking strategy. Quantum computing was never about instantaneous disruption; it’s about sustained evolution toward milestone achievements. If you’re a Fortune 500 executive, government official, or major investor, here are my best recommendations:

Stay the Course with a Dual Strategy

Hardware: Keep an eye on evolving roadmaps and gauge the maturity of qubit technologies.

Software & Algorithms: Invest in quantum software ecosystems, focusing on short- to mid-term proofs of concept that de-risk your broader strategy.

Anticipate the Regulatory Imperative

Post-Quantum Cryptography: Begin or accelerate your transition to PQC standards now, as governments worldwide are turning the regulatory screws.

Security & Compliance: Factor quantum-readiness into your cybersecurity budgeting, especially given looming mandates.

Focus on Industry-Specific Use Cases

Healthcare, Energy, and Manufacturing: Prioritize quantum PoCs where the upside is largest and the product cycles most benefit from advanced simulation and optimization.

Talent & Expertise: Collaborate with domain-savvy partners who can build or tailor quantum algorithms specific to your industry’s highest-impact challenges.

Increase Vendor & Research Partnerships

Diversify Your Allies: Don’t rely on a single technology stack or vendor. The quantum space is dynamic; hedging your bets with multiple approaches is wise.

Co-Investments: Pool resources with peers or government grants to accelerate quantum research and technology readiness.

Keep the 2030 Milestone in Perspective

Milestones vs. Hype: Realistic milestones (such as achieving 100+ logical qubits) remain on track. Stay agile, but don’t abandon your long-view strategic bets because of one set of cautionary remarks.

Long-Term Vision: Quantum computing will slowly disrupt entire value chains. Position your organization to capitalize, rather than be forced to play catch-up down the line.

Markets can be skittish - and many CEOs relish the spotlight - opinions from tech luminaries will understandably shake short-term perceptions. But quantum computing remains an arena with enormous long-term strategic value. Your best defense against the ups and downs of the hype cycle? A balanced, proactive strategy that continuously readjusts around emerging technical, regulatory, and commercial realities.

Give me a call, Jensen - quantum school is in session!

#QuantumIsComing

This is my personal newsletter, all opinions are mine and do not represent GQI, The Quantum Computing Report and other affiliated entities.

Great article! The way you broke down the importance of balancing hardware and software in quantum computing really got me thinking. As the technology evolves, do you think the hybrid approaches will become the norm in industry applications or will the focus eventually shift more towards fully fault tolerant quantum systems?