Quantum Winter - or is there a better question?

Insights on the global Quantum Tech ecosystem

I often get asked about ‘Quantum Winter’ and as someone who escaped the Northeast for Miami Beach 4 years ago that gives me chills in more than one way.

Y2Q - a quick analysis

Before we talk about chilly temperatures, let’s take a look at another emerging doomsday label that is making the rounds: Y2Q.

A look at the Quantum Security space shows 111 firms active in that field.

While some firms emerged as early as the 90’s, and others, in the cyber security space, recognized and started to address the quantum security threat in the early 2000’s, the bulk of companies is less than 6 years old.

In fact, almost 70 out of the 111 firms that we count have been founded in 2016 or later.

It is also noteworthy that the years 2020 and 2021 saw fewer ventures in the space emerge, which might be due to the rise of quantum computing startups at the same time that monopolized much of the available venture capital in quantum tech for a couple of years.

Another factor in this is most certainly the talent shortage with a lot of the existing players tying up the leading experts and resources in their growing businesses.

A full list of all the 111 companies in quantum security is available, along with their categorizations and other details.

This also includes a few large OEMs, especially equipment makers, that have a dedicated product focus on QKD solutions specifically.

At this point it is also important to note that we only count verifiable data points meaning that entities, which we are not able to verify, are not counted. Furthermore, some regions, such as Russia and China, publish little verifiable data, probably skewing the results for some regions.

In that context, it is no surprise that the USA hosts almost a quarter of the vendors on our list, followed by Canada & the UK with about a dozen each and Germany on their heels.

New monikers are emerging as well. Besides QKD and PQC, TrUE is one such example, created by Canadian startup Quantropi. For them, it is all about trust, uncertainty and entropy.

Y2Q is a process - a mindset, really - that has started already and organizations that want to prepare for it need to adopt a continuous, agile and comprehensive defense posture against it with the right tools and partners to fight this threat as quantum technology matures and deploys.

The “year quantum” is today.

Y2Q is coming for sure. But is Quantum Winter coming?

My friend Christopher Bishop will be discussing exactly that question at the upcoming Economist Conference in London - Commercializing Quantum.

Myself, I will be moderating a panel on “exploring the appetite for collaboration on quantum for the greater good—early outcomes and the opportunity at stake” with Carol Monaghan (Scottish National Party MP), Carlos Kuchkovsky, Ling Ge and Ray LaFlamme.

Don’t miss either one, or the many other fantastic speakers, and sign up now #quantumiscoming #EconQuantum

Collaboration is something that happens every day across our Quantum Universe, and you don’t always have to agree with each other, to support one and another. A great example of that is Brian with his daily posts on different quantum tech topics that bring together a vast set of people for discussion, check them out on LinkedIn and join the conversation:

Back to our question at hand… will there be a Quantum Winter or not?

Quantum Winter or the art of predicting a bubble

What is a bubble aka winter?

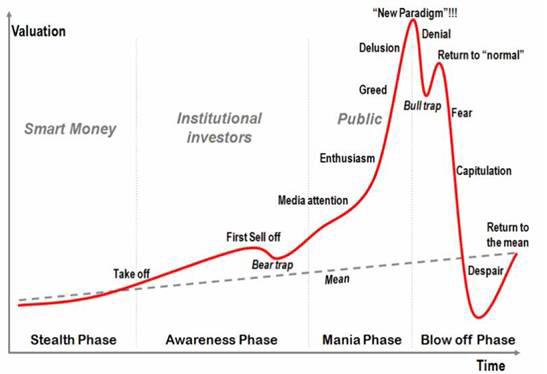

According to Investopedia a bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a "crash" or a "bubble burst."

Typically, a bubble is created by a surge in asset prices that is driven by exuberant market behavior. During a bubble, assets typically trade at a price, or within a price range, that greatly exceeds the asset's intrinsic value (the price does not align with the fundamentals of the asset).

In other words, a bubble - or, for our sake, Quantum Winter, is when a rapidly rising asset class (Quantum Technology) fails to deliver on the expectations (hype) sustained by its key stakeholders (investors, vendors, media).

A bubble in itself is not a terrible thing, just as long as it doesn’t burst, and can survive for many years at end without significant consequences to the underlying asset - our quantum tech ecosystem and progress.

The causes of a bubble

There are many factors that can cause an asset bubble to occur. Economics Help lists the following as the key drivers.

Irrational exuberance. In certain circumstances, investors can buy assets because of strong psychological pressures which encourage them to ignore the fundamental value of the asset and believe that prices will keep rising.

Herding behavior. People often assume the majority can’t be wrong. If banks and well-established financial leaders are buying, they assume it must be a good investment. (the economics of herding and irrationality)

Short-termism – people make decisions based on short-term rather than long-term.

Adaptive expectations. People often judge the state of a market and economy by what has happened in the recent past.

Hope they can beat the market. People believe they can beat the market and get out before the bubble pops.

Cognitive dissonance – filtering out of the bad news and looking for views which reinforce their beliefs.

Financial instability hypothesis. The theory that periods of economic prosperity cause investors to be increasingly reckless leading to financial instability.

Monetary policy. Sometimes bubbles occur as an indirect consequence of monetary policy. For example, the FED’s decision to keep interest rates in the US low encouraged the credit bubble of the 2000s. Excess liquidity can more easily lead to bubbles because people need somewhere to put their money.

Global imbalances. Some argue the US financial bubble of the 2000s was caused by an inflow of currency from abroad. The US ran a trade deficit and attracted hot money inflows, leading to higher demand for US securities. This kept interest rates lower and values of US higher than they otherwise would be

In fact, economists agree that there is no clear indicator of a bubble - it can be an isolated factor, a combination of many, or a black swan event, which creates a winter.

We do know certain things to keep a lookout for, though.

Any number of factors, from easy money to irrational exuberance to speculation to policy-driven market distortions, may have a hand in the inflation and bursting of bubbles. Each school of thought thinks that its analysis is the correct one, but we have yet to reach a consensus on the truth.

So if a bubble in itself is not dangerous until it bursts - or winter comes to ruin my Miami Beach days - then what are the factors that lead to such a crash?

What causes a bubble to burst?

Referring back to Investopedia, again, there are generally 5 stages that can be distinguished:

1. Displacement

A displacement occurs when investors get enamored by a new paradigm, such as an innovative new technology or interest rates that are historically low. A classic example of displacement is the decline in the federal funds rate from 6.5% in July 2000, to 1.2% in June 2003.6 Over this three-year period, the interest rate on 30-year fixed-rate mortgages fell by 2.5 percentage points to a then-historic low of 5.23%, sowing the seeds for the subsequent housing bubble.7

2. Boom

Prices rise slowly at first, following a displacement, but then gain momentum as more and more participants enter the market, setting the stage for the boom phase. During this phase, the asset in question attracts widespread media coverage. Fear of missing out on what could be a once-in-a-lifetime opportunity spurs more speculation, drawing an increasing number of investors and traders into the fold.

3. Euphoria

During this phase, caution is thrown to the wind, as asset prices skyrocket. Valuations reach extreme levels during this phase as new valuation measures and metrics are touted to justify the relentless rise, and the "greater fool" theory—the idea that no matter how prices go, there will always be a market of buyers willing to pay more—plays out everywhere.

For example, at the peak of the Japanese real estate bubble in 1989, prime office space in Tokyo sold for as much as $139,000 per square foot.8 Similarly, at the height of the Internet bubble in March 2000, the combined value of all technology stocks on the Nasdaq was higher than the GDP of most nations.9

4. Profit-Taking

In this phase, the smart money—heeding the warning signs that the bubble is about at its bursting point—starts selling positions and taking profits. But estimating the exact time when a bubble is due to collapse can be a difficult exercise because, as economist John Maynard Keynes put it, "the markets can stay irrational longer than you can stay solvent."

In Aug. 2007, for example, French bank BNP Paribas halted withdrawals from three investment funds with substantial exposure to U.S. subprime mortgages because it could not value its holdings. While this development initially rattled financial markets, it was brushed aside over the next couple of months, as global equity markets reached new highs. In retrospect, Paribas had the right idea, and this relatively minor event was indeed a warning sign of the turbulent times to come.

5. Panic

It only takes a relatively minor event to prick a bubble, but once it is pricked, the bubble cannot inflate again. In the panic stage, asset prices reverse course and descend as rapidly as they had ascended. Investors and speculators, faced with margin calls and plunging values of their holdings, now want to liquidate at any price. As supply overwhelms demand, asset prices slide sharply.

Quantum Winter - yay or nay?

Quantum Winter and other weather forecasting

Let’s break down what we learned above, step by step, and apply it to Quantum Tech.

Do we have a bubble?

We learned that a bubble is defined by a rapid increase in market valuations followed by a quick decrease, or concentration, in value.

Rapid increase in market valuations

This is undoubtedly the case in Quantum Tech. National Quantum Strategies across the globe keep exceeding each other in volumes and pace. Not only are the typical suspects in North America, Europe, the UK, Australia, Japan and Israel upping the ante, but smaller quantum players like India, South Africa or France are making significant commitments to their Quantum Tech programs that outdo previous efforts by a factor of 3 to 5 in financial commitments.

On the private capital size the picture is just as dramatic. 4 SPAC deals that brought in over $2B in the last 12 months, and, so says the grapevine, a small handful more coming this year. VCs, too, are starting to write the big checks, with B, C and D rounds that increase funding for many leading startups by a factor 2 to 4.

And, the ecosystem itself - from events, conferences to jobs and outreach - has certainly tripled or more in output over the last year.

Quick decrease or concentration of value

This has not been the case so far, with an asterix.

While many of the SPAC deals that have gone public seem to struggle in the markets, often down by 20 or 30% from their opening price, this cannot yet be qualified as a crash.

Government programs are funded for years and striving.

Private ventures have between 1 and 3 year of runway on average with their current balance sheets, securing jobs, client relationships and business development.

Also, and I have been predicting industry consolidation for a while now, no huge concentration of value has taken place yet. While there have been a handful of acquisitions in the ecosystem, and certainly more coming, the overall market is growing and diversifying.

An asterix why? There is simply not enough mass - public companies, known valuations, revenue trends, etc - that one might be able to measure to make such a statement.

So do we have a bubble or quantum winter? Definitely not today when going by the definitions taught to us by economists. There are some signs but currently not enough fire to produce smoke.

What might cause a Quantum Winter?

Looking at the leading indicators provided above, 4 risk factors that might accelerate a Quantum Winter stand out to me:

Irrational exuberance. Quantum Tech has gone from spooky to sexy, everybody wants to be part of it. And while it is not yet the new bitcoin, awareness of quantum is spreading to the mass media, public, uneducated investors and a plethora of experts and consultants. And we aren’t even halfway through the NISQ era yet - if we don’t stay grounded then unjustified hype might cause our downfall

Short-termism. Markets and investors. The cat is out of the bag, many companies and startups are now bound by public markets, boards of directors, revenue projections and product milestones. If we start focusing on those and sacrificing science & engineering in the process then we will be in trouble

Cognitive dissonance. I actually very rarely see bad news in quantum. All news is good. Is that normal? Can’t possibly be, or can it?

Global imbalances. The quantum game is skewed, the geopolitical situation the most uncertain in almost 80 years and the technology we are working on is a national security concern. This is the real powder keg since we still depend on academic, scientific and engineering collaborations across borders to deliver on the quantum promise.

Short termism, driven by a few vendors, and the geopolitical landscape is what worries me most and could create a real bubble overnight.

What might burst the Quantum Bubble?

Predicting the above factors takes a quantum computer. Literally. Anyone?

Historically, the causes leading to the bursting of a bubble have typically been minor - just like the weather where a small change in temperature or air pressure suffices to turn Miami Beach from a sunny paradise into a stormy mess.

In my assessment, referring to the 5 stages of a bubble defined in the intro, we are currently transitioning from ‘boom’ to ‘euphoria” - I do not think that we have reached that level of ecstasy yet. Our quantum universe is still too small, too isolated for that; and many are focused on the hard work - scientific, engineering, building - it takes to make it all work.

It won’t take much, though. A new announcement of an unexpected quantum volume. News of a customer use case that truly moved the needle. A large, and I mean a very large, deal in the markets - all within the realm of the possible and a concoction that could very quickly rise to euphoric levels, greedy profit taking and a panic before we know it.

We are clearly not there yet but thinking through the different scenarios, within the frameworks provided above, might give you a better sense of where we stand and where we are heading.

How to predict Quantum Winter

The tricky thing, though, is that it is impossible to predict a bubble. In the economic literature there is no evidence of such luck ever having been grounded in method - bubbles are of elusive nature, when you notice them they have already enveloped us and become so fragile that a bursting is hard to avoid.

The New York Times tells a fun story of the perpetual ‘tech bubble” that never burst - it’s been 10 years in the making and still no sign of it crashing. But the experts keep ringing the alarm bells. Cautious or self-serving?

My favorite takeaway from this is a conversation between two of my professors from the University of Chicago that I had the privilege to study under. One of them is a Nobel Prize winner for efficient market theory, the other a Nobel Prize winner for behavioral economics.

They had at it for 45 min, gloves off, and concluded that markets are efficient, or, that at least, that is the best model of economic (and tech) reality that we have. This means that it is impossible to predict a bubble

So will there be a Quantum Winter? The only true answer is: nobody knows!

Instead of fueling a debate about it at conferences, events and on social media, let’s use our time to control the KPIs that we can control - let’s grow revenues, let’s innovate use cases, let’s collaborate and partner, and maybe, just maybe, the sun will shine on all of us in the quantum universe.

And if not, you are all invited to Miami Beach, where the sun always shines.

We launched a number of new analysis, notably:

An updated dashboard on Investments in Quantum Tech

A new dashboard on PQC, QKD and Y2Q

A new dashboard on the Quantum Tech ecosystem in Germany

If you would like to learn more about any of them please reach out directly.

Since appointing Dr. Rupesh Srivastava as our CEO, OneQuantum has accelerated its growth, mission and culture. Learn more in our newsletter here

Women in Quantum continues to lead the way.

And Africa is making big strides

Together with David Shaw, Doug Finke, James Sanders and Shahin Khan we launched The Quantum Analyst Roundtable 2 months ago to provide in depth analysis of the Quantum Tech ecosystem globally.

Check us out online or on YouTube - I promise it’s time well spent.

News & Updates

We share news and events in all of our amazing OneQuantum newsletters and I encourage you to check those out to stay up to date with the latest.

Personally, I am a big fan of Sergio Gago’s weekly news update (see below) and won’t even attempt to outdo him - go read Quantum Pirates 🏴☠️

If you’ve been forwarded this free edition of our Quantum Tech newsletter, you should subscribe so as not to miss the next ones.