Quantum Tech and the need for enterprise grade use cases or bold ideas

Pragmatic thinking for an immature market

Happy World Quantum Day!

My writing has been sporadic recently - apologies to those of you who miss it - as I’ve been lucky enough to travel the world and spread the word on quantum. Use cases are a topic that comes up again and again. So here are some quick thoughts on how to think about it pragmatically - full disclosure, no silver bullets are to be found in this post.

Also, very excited to be partnering with CogX in London at the O2 Arena this fall - the leading innovation festival in the world.

The need for enterprise use cases

Certainly, a lot of work remains to be done on hard- and software in quantum tech, especially computing. We lean on a tremendous brain trust and energy to accomplish this, with well defined product roadmaps, that make me confident we will be able to put technical challenges to bed within 3 - 5 years.

Quantum algorithms are a different cup of tea but, for the purpose of this article, I will operate on the principle of hope in that respect.

With that, use case discovery is on everybody’s mind - for better or worse. No point to argue about the readiness of the technology anymore and better to focus that energy on actually making an impact.

The IQT Nordic Summit - join us in Denmark and RSVP now

Where are vendors making money today?

By now, we all are accustomed to “earning announcements” in quantum tech. What would have seemed ludacris to many just a year ago, now is part of our routine as we check in on the latest news in our sector. Do these announcements suggest a breakthrough in applications? Well, if you look closely, current revenues are messy and not scalable:

Cloud - this is the number one revenue contributor across quantum computing; and definitely a scalable exception. Due to the computational complexity of quantum algorithms they quickly rack up a significant amount of “cloud credits”, the unitary value IBM, Google, Azure or AWS measure their cloud revenues by. The market for this is still in its infancy and will continue to grow significantly. However, this is limited to a small number of vendors, most of which are OEMs

Consulting - nobody talks about it, everybody does it. In fact, what is packaged as a partnership (see below) is, in essence, nothing else but a consulting agreement in quantum tech. Of course, you cannot scale that advisory service without scaling the underlying technology - chicken or the egg - hence, this market, non-core to most ventures, is limited in its size and growth

R&D partnerships - while these include more than consulting (think software, compute seconds, algorithms, etc) they are R&D focused. And while those budgets are fueled by seemingly endless government grants, R&D is a long term market for only a few players. Scale can only come in the commercial market.

Education - extremely necessary and urgent, the little sister to consulting, we see more and more vendors offering educational products and services as part of their revenue mix. Again, a scalable market for only a handful of providers. The pie simply ain’t big enough.

Revenues from what we would consider an “enterprise use case” trend towards nill in this current context.

What you will see in the next couple of years

Where are vendors looking for new/more revenues?

Long term partnerships - we see the re-emergence of long term partnerships. Pioneered by IBM who used to ink multi year, multi million dollar deals with customers in quantum. There is a small set of large startups out there that is bringing this approach back for specific mega applications (think quantum + AI, for example)

Private clouds - the success of the cloud is undeniable but not everybody will make it onto AWS or Azure, or want to split their revenues. In consequence, more and more startups are looking into offering their own private clouds

HPC market - IQM and European HPC centers were most likely the first to explore this route to market, and successfully though. While the number of HPC centers is limited, and on-premise hardware presents a different price point than cloud, this is a viable market

Data center market - other ventures are replicating this approach with data centers, a larger overall addressable market and, clearly, closer to the data. If you’re able to find trusting clients this is an interesting new target segment

Small, hybrid use cases - the biggest “success story” in the commercial quantum world is a handful of vendors that are seeing increasing enterprise traction by being very very smart. Specifically, this means that they have figured out how to combine world-class SME with very narrow (optimization) problems to which they can bring a quantum advantage in tandem with classical resources

These are all very promising and intelligent approaches that we are excited to see progress. Yet, again, not a commercial enterprise market at scale for more than a small handful of vendors at best. The pie simply ain’t big enough.

Where to find long term enterprise revenue?

If the above doesn’t offer a satisfying answer then where do we find it? Well, it is not what you expect. It is twofold:

Take a proven enterprise sales approach

Be bold

Probably these two are mutually exclusive so as a vendor you’d have to pick either one.

Why enterprise sales is so hard for quantum tech vendors

The reason behind that is simple - it takes a lot of resources to execute and quantum tech is still immature. Hence, many are taking - warranted - shortcuts and run directly towards a set of well known use cases hoping to demonstrate progress.

This is a viable strategy for a handful of vendors at best. The pie simply ain’t big enough.

And at the enterprise level it’s all about having the breath and focus to succeed. Let’s get pragmatic on how to do this.

Find your opportunity

As simple as this sounds, when we speak to vendors, and we speak to them every day, we still see little of this.

Take the time to clearly analyze, understand and define what your specific opportunity is.

Define your TAM/SAM/SOM

Any b-school grad can recite this in their sleep, yet, again, we see few vendors out there who have a clearly articulated understanding of their buyer.

Founders and VCs alike too often get blinded by the TAM and fail to properly define & size the SAM/SOM, see here for a vivid example by The Information.

Tell your story

Marketing and branding is crucial and your buyer is emotional and human - less tech, more business case and more references is what is needed.

And while we see more and more vendors hiring PR teams, and some really cool branding out there, many still do not execute on a consistent marketing strategy. See this guide by TechCrunch if you want to get serious about it.

Your buyers have very specific expectations, that are not as much about your quantum chops as you might think - see here These buying decisions are made by a team and rooted in a business case, and, many times, the buyer doesn’t know how to buy your product well and needs your help in deciding see Gartner

That is the purpose of marketing, not, in fact, building a nice website.

Be realistic about your runway

Deep tech is hard to measure/compare, especially in the early stages. Deep tech startups can take a risk on market timing, which means that there’s less traction to evaluate and more emphasis is put on the team and the defensibility of the IP. Part of the challenge in deep tech is getting to revenue and scaling. There’s a slower adoption curve than SaaS or consumer, and it often requires market education and selling services to enter the market.

Be sure you understand how to appropriately resource the various steps of that ladder.

Sales has changed

The days of campaigns and account reps are gone. Today, it takes leaders who are experts and personally close the deal.

The issue here is that many founders are simply too smart.

But don’t necessarily have the skills - or affinity - for sales.

So they hire somebody from the outside, with fancy credentials and pedigree, to do the selling.

…and then wonder why it is not working.

In early stage DeepTech, selling is the founder’s & CEO’s task since it is as much about business development as it is about revenue. You have to build and maintain that feedback loop and as soon as you outsource it, you will lose touch - and fail to close deals.

This is the single biggest mistake in quantum tech at this point with respect to taking the next growth step.

Buying revenue

This is a strategic pillar, which, too, is all too often lacking in quantum tech. And you don’t need millions in the bank to start executing on it. Even small steps make a big difference, just like on the moon…

A famous study from the 70’s shows how your overall cash position dramatically increases with scale. And the fundamental economics of this hold true today.

There is a very good reason to buy market share to increase revenue. There is also a reason to buy market share to gain SME expertise - a critical ingredient as discussed above.

Companies often have to make these build vs buy decisions; an interesting analysis by BCG looked at this question in the context of Artificial Intelligence in 2018.

I propose a similar framework to help Quantum Tech companies facilitate build vs buy decisions.

Pragmatically this means that you want to:

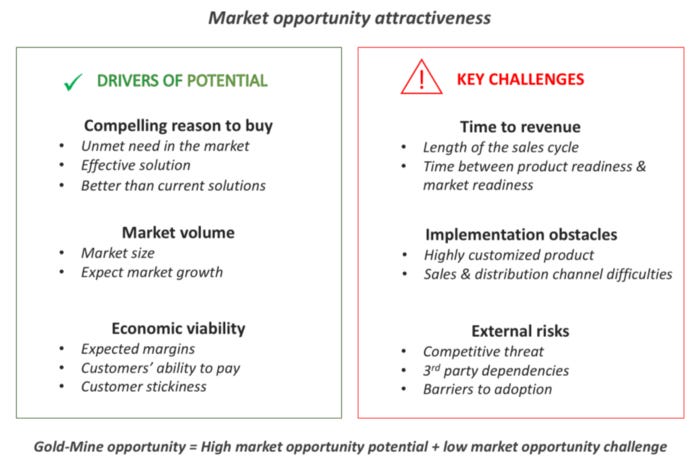

Buy commodities

Buy into the danger zone

Build your gold mines

Build your hidden opportunities

Have you mapped this out for your company?

The above is standard practice in enterprise technology and it is super hard to execute on. But, for those that don’t want to compete in the rat race of messy revenues (the pie ain’t big enough) it is the only way:

Find your opportunity - who is it that you are and what do you offer (hint: it’s not qubits)?

Define your TAM/SAM/SOM - actually write it down and execute on it

Tell your story - be human and authentic

Be realistic about your runway - running out of cash sucks

Sales has changed - the founder led feedback loop

Buying revenue - build/partner/buy

Unless you are bold!

Need for bold ideas - let’s think big

It’s no secret and by now you most likely have caught on to it - my personal favorite: be bold. Quantum tech is so beautiful, so utterly weird and scary, it deserves the best of humanity.

But business doesn’t work that way…

How do we reconcile these two ends of the spectrum?

A bold startup able to tell a unique and exciting story that will attract large resources

Bold countries/regions with a vision

A left field mid sized company with nothing to lose (hello German Mittelstand)

Tony Stark - what do you mean he is not real?

Joking aside, an educated guess and smart bet is what historically moved humanity forward the most - we should put boldness back on the table.

It’s that simple.

Young - how to generate new ideas

Before we conclude, a little side note on creativity and tenacity. One of my favorite books is by JW Young and titled “A technique for producing ideas”. I find it inspiring in the sense that so many in our ecosystem are intensely focused on iterating the existing and lose sight of the new. Maybe there is an opportunity to widen our horizons, here is how Young suggests we go about it:

Step 1: gather new material. This includes specific material (related to the product or task) and general material (fascination with a wide range of concepts).

Step 2: work over the materials in your mind. Mentally “chew” your new material by looking at the facts from different angles and experimenting with fitting ideas together.

Step 3: put the problem completely out of your mind and go do something else that excites you and energizes you.

Step 4: your idea will come back to you with a flash of insight, only after you have stopped straining.

Step 5: shape and develop your idea into practical usefulness. Put your idea out into the world, submit it to criticism, and adapt it as needed.

On getting intimate knowledge of a product: most people stop too soon. If the surface differences are not striking, we assume that there are no differences. But if we go deeply enough, or far enough, we nearly always find that between every product and some consumers there is an individuality of relationship which may lead to an idea.

The greatest way to develop general knowledge on a subject is to get genuinely interested in something. Living in a curious way and becoming fascinated with things is a fantastic way to live and it will ensure you never run out of ideas.

The more general knowledge you have, the more opportunity you have for creating new relationships and connections between ideas.

Conclusion

The answer to our questions comes down to a simple conundrum - what do you want to bet on?

Be the best in a crowded field? Crack the enterprise? Be bold?

No matter your choice, there is a strategic and tactical level at which we need to better execute.

Strategy

For quantum to succeed, we need commercial (not R&D) enterprise use cases. All other addressable markets are too small or not scalable

Companies need to define clear and differentiated strategies rather than being also runs. Pick your differentiation - the 4 corners of the quantum universe are starting to clearly emerge

A narrow focus is the most undervalued virtue

Tactics

Subject Matter Expertise - most lack it, use cases depend on it

Branding - customers buy stories and emotions, even in quantum

Protect your runway, this stuff takes time

Execution

To find long-term enterprise value strategic and tactical execution is required

Founder leaders - if you have a PR agency and a Head of Biz Dev that used to work for Oracle then you’re probably failing

A build/partner/buy strategy - you should have an M&A partner

However, this won’t be enough, for the ecosystem at large, to answer the use case question - the pie, at least as we know it today, simply ain’t big enough.

Bold ideas - and yes, this means taking a big business risk - is what we need most on the road to enterprise use cases. Why would you work on one of humanity’s biggest technological leaps to date and think small! Just to make a few million?

At the end of the day, the answer to use cases in quantum is simple. The missing ingredient is you. So make sure you live curiously and go far enough.

#QuantumIsComing

This is my personal newsletter, all opinions are mine and do not represent GQI, The Quantum Computing Report and other affiliated entities.